Belinda stared at her credit card statement, wondering how her family’s debt had spiralled so far out of control despite their strong faith. Many Christians struggle with this same disconnect between their spiritual beliefs and financial reality. Many Christians struggle with a disconnect between their spiritual beliefs and their financial reality due to a combination of theological confusion, shame, poor financial literacy, and the pressures of a secular, consumerist culture. This tension arises from trying to balance biblical principles of faith and stewardship with everyday worldly pressures. Biblical teachings on money are complex and sometimes seen as contradictory, which can lead to confusion.

Table of Contents

ToggleAt Life Purpose Matters, we believe Christian finances should reflect biblical wisdom, not worldly pressures. God’s Word offers clear guidance for managing money that leads to both financial freedom and spiritual growth.

How Does God Want You to Handle Money?

God Calls You to Be His Money Manager

God calls Christians to be stewards, not owners, of financial resources. Psalm 24:1 states that everything belongs to the Lord, which makes us managers of His wealth rather than independent decision-makers. This perspective changes everything about money management.

Instead of focusing on accumulation, biblical stewardship emphasises faithful management of what God provides. True stewardship means you make decisions that honour God’s ownership while you meet family needs responsibly.

Tithing Transforms Your Financial Foundation

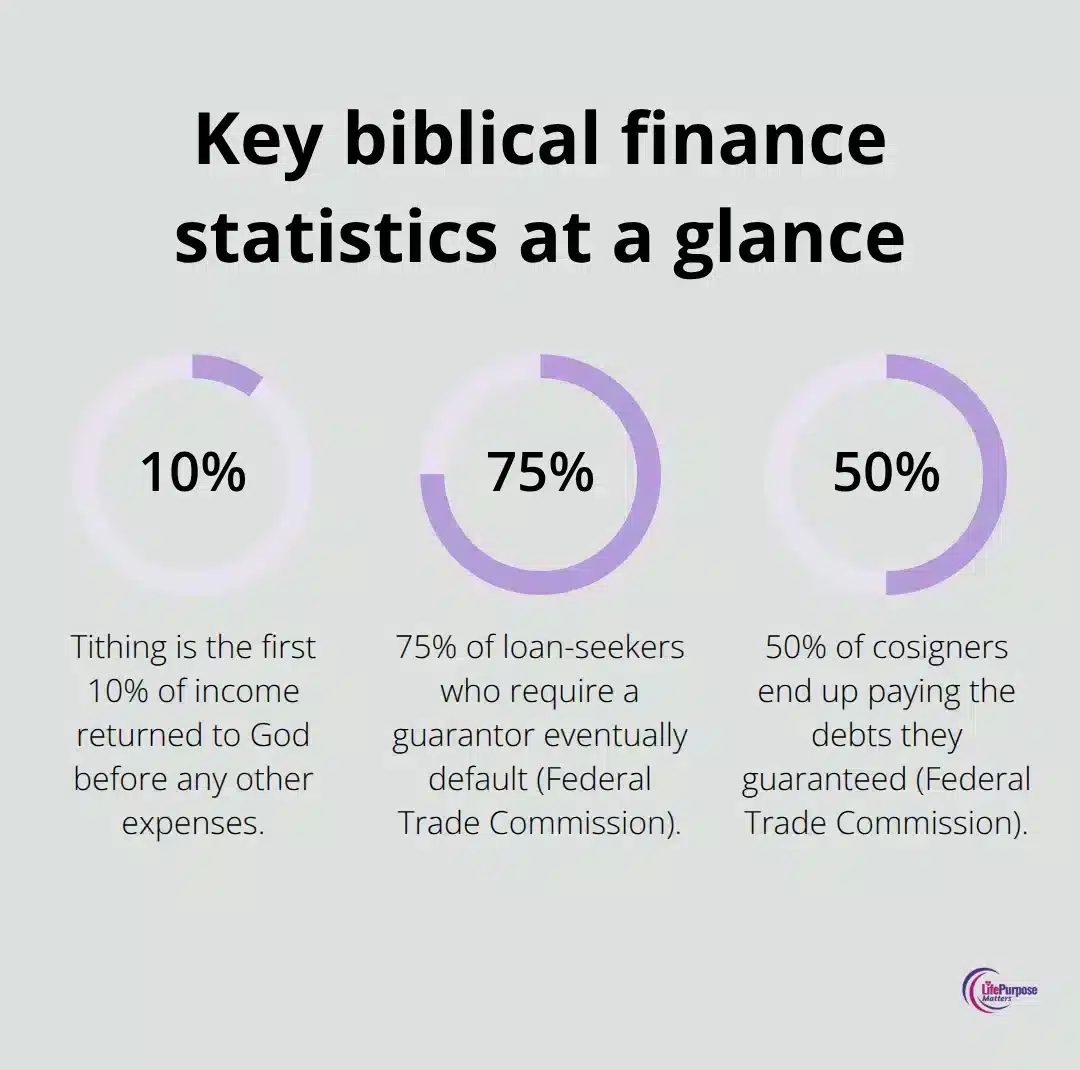

Tithing represents the first 10% of income returned to God before any other expenses. Malachi 3:10 promises that God will open heaven’s windows for faithful givers. Research shows generous givers receive approximately $3.75 back for every dollar donated to charity, but tithing goes beyond financial returns.

It builds trust in God’s provision and breaks the grip of materialism. Many Christians struggle with tithing when money feels tight, yet this act of faith often opens unexpected opportunities. Start with whatever percentage feels manageable, then increase gradually as trust grows.

The average American family spends more than they earn, but families who tithe learn to prioritise God’s kingdom over consumer desires.

Debt Destroys Biblical Financial Freedom

Proverbs 22:7 warns that borrowers become servants to lenders, and this slavery mindset contradicts Christian freedom. The average American carries significant credit card debt and pays hundreds in interest monthly instead of building wealth. Biblical money management demands keeping out of debt because debt payments steal resources meant for generosity and kingdom work.

Create a debt elimination plan that pays minimums on all debts while you attack the smallest balance first. This approach builds momentum and confidence. Avoid new debt entirely during this process (even for seemingly good reasons). Emergency funds prevent future borrowing when unexpected expenses arise.

The next step involves creating practical systems that turn these biblical principles into daily financial habits.

How Do You Build Biblical Financial Systems?

Start With Prayer-Centred Budgets

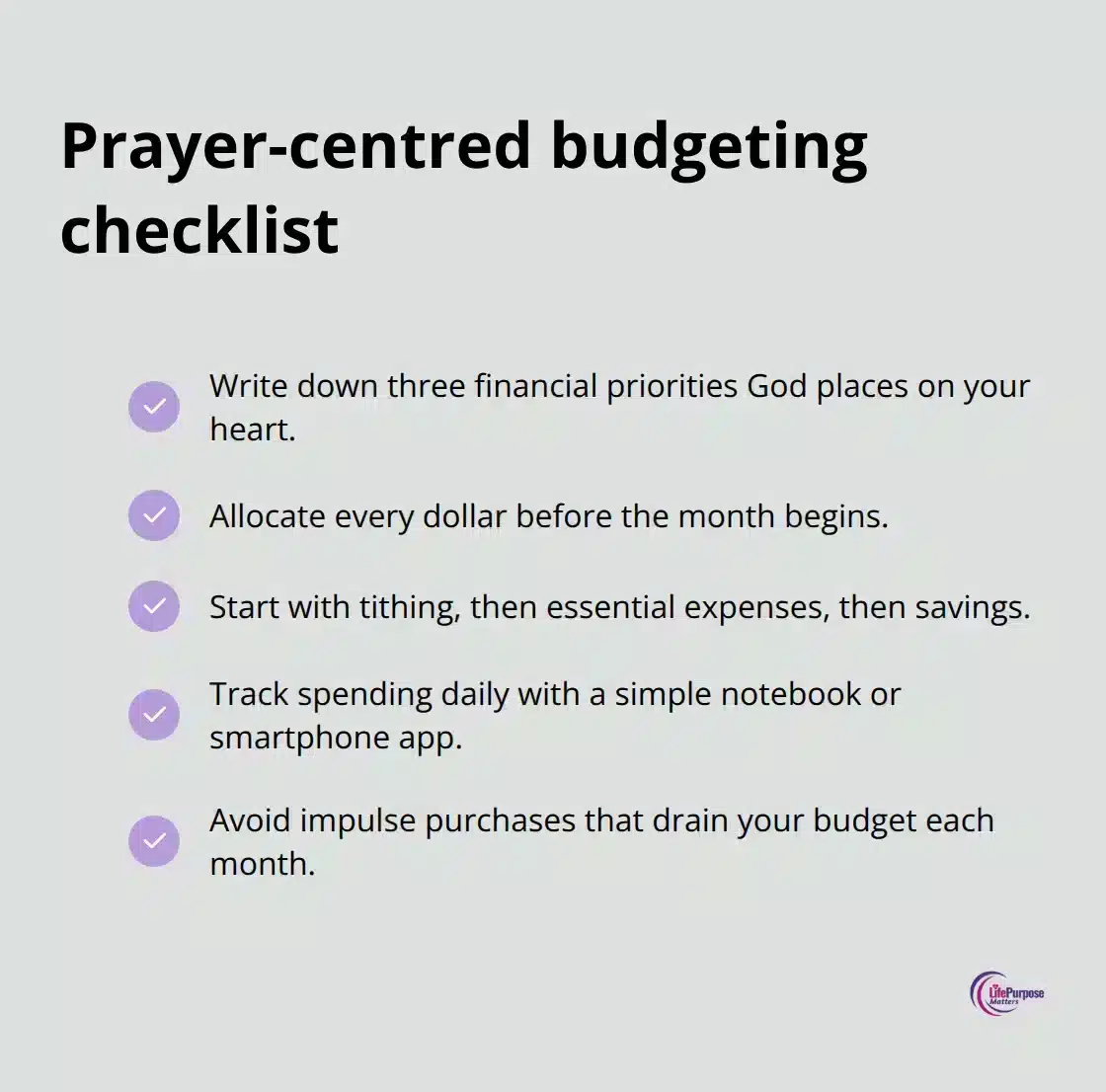

Biblical budgets begin with prayer, not spreadsheets. Spend 15 minutes weekly and ask God to guide your financial decisions before you allocate a single dollar. The Federal Trade Commission reports that 75% of loan-seekers who require a guarantor eventually default, yet most Christians make major financial decisions without divine wisdom first.

Write down three financial priorities God places on your heart, then build your budget around these kingdom-focused goals. Allocate every dollar before the month begins. Start with tithing, then essential expenses, then savings.

Track spending daily with a simple notebook or smartphone app. Most families waste $400 monthly on impulse purchases they cannot remember making two weeks later.

Build Emergency Savings Through Faithful Stewardship

Many Americans struggle with emergency preparedness, but biblical wisdom demands different preparation. Proverbs 21:20 emphasises that wise people save for the future while fools consume everything immediately. Start and save $25 weekly until you reach $1,000, then increase to three months of expenses.

Open a separate high-yield savings account specifically for emergencies and never touch it for non-emergencies. Scripture teaches that God provides through seasons of plenty for seasons of need (just like Joseph stored grain during abundant harvests). Automate transfers to your emergency fund immediately after tithing comes out.

Apply Biblical Investment Principles

The average person lives just three weeks from bankruptcy, but Christians who follow biblical saving principles build lasting financial security. The parable of the talents in Matthew 25:14-30 shows that God expects wise investment of resources, not fearful hoarding under mattresses.

Consider low-cost index funds that spread risk across many companies rather than individual stocks that create gambling-like behaviour. Proverbs 12:15 reminds us to seek counsel before major decisions (including investment choices). Consult with godly financial advisers who understand both markets and biblical principles before you commit significant amounts.

These practical systems create the foundation, but developing a Christ-centred mindset helps many Christians avoid common financial traps that undermine their progress.

What Financial Lies Do Christians Believe?

The Prosperity Gospel Ruins Biblical Stewardship

Prosperity gospel teachers promise that faith automatically produces wealth, but this dangerous misconception leads Christians into financial ruin. Many believers assume God wants them rich and use this twisted theology to justify overspending on luxury items they cannot afford. Research from the Federal Trade Commission shows that 50% of cosigners end up paying debts they guaranteed, yet prosperity preachers encourage believers to step out in faith with borrowed money.

This false teaching transforms biblical stewardship into selfish materialism. True biblical prosperity means having enough to meet needs and bless others, not accumulating designer clothes and expensive cars. Stop chasing wealth as proof of spiritual maturity and start managing money according to Scripture instead.

Planning Shows Faith, Not Fear

Many Christians avoid financial planning because they believe it demonstrates lack of trust in God’s provision, but this mindset creates unnecessary hardship. The average American family lives paycheck to paycheck, and Christians who refuse to budget often struggle more than unbelievers who plan wisely.

Proverbs 21:5 clearly states that the plans of the diligent lead surely to abundance while everyone who acts in haste comes surely to poverty. God expects believers to count costs before building (just like the king who calculates resources before going to war). Create detailed budgets, track expenses monthly, and set specific savings goals. Planning actually honours God by stewarding His resources responsibly rather than wasting them through poor decisions.

Credit Cards Become Modern Slavery

Christians fall into debt traps because they view credit as emergency solutions rather than spiritual bondage. The average American carries significant credit card balances and pays hundreds in interest monthly instead of building wealth for kingdom purposes. Many believers justify debt for seemingly good reasons like Christian education or church activities, but Proverbs 22:7 warns that the borrower is slave to the lender regardless of the purpose.

When facing financial stress, stop using credit cards for anything except absolute emergencies you can pay off immediately. Cut up cards if self-control becomes impossible. Every dollar paid in interest steals resources from tithing and generosity that God intended for His work.

Final Thoughts

Biblical money management transforms lives when Christians replace financial anxiety with peace through God’s wisdom. Christians who align their finances with Scripture experience freedom from debt slavery and discover the joy of generous giving. The transformation affects marriages, families, and spiritual growth beyond bank accounts.

Your faith-based financial journey requires three immediate steps. First, commit to tithing before you pay any other bills and trust God’s promise in Malachi 3:10. Second, create a prayer-centred budget that allocates every dollar according to biblical priorities. Third, eliminate all debt while you build an emergency fund (using the momentum method that attacks smallest balances first).

Christian finances work best when believers balance trust in God’s provision with responsible stewardship. God expects faithful management of resources while He handles the results. At Life Purpose Matters, we provide Christian living inspiration to help you integrate faith into daily financial decisions.