I once met a pastor who tracked his spending in a spreadsheet like it was a spiritual practice. He wasn’t obsessed with money, he was obsessed with alignment. His budget reflected his values, his giving reflected his faith, and his financial decisions felt less like obligations and more like expressions of who he believed God called him to be.

Table of Contents

ToggleThat’s what Christian financial planning really is. At Life Purpose Matters, we believe your money should tell the story of your convictions, not contradict them. This guide walks you through building a financial life that honours both your faith and your future.

Understanding Biblical Principles of Money Management

God Owns Everything-You Manage It

God owns everything. That’s not metaphorical or inspirational fluff-it’s the foundation that changes how you handle money. When you accept that God is the owner and you’re the manager, your entire relationship with finances shifts. You stop viewing money as something to protect at all costs and start viewing it as a tool to steward well. This distinction matters because stewardship means treating money as a trust, not a possession.

A pastor who tracks spending in a spreadsheet isn’t being legalistic-he’s being responsible. He asks the question every Christian should ask: Does my financial life reflect what I actually believe? Russ Crosson, who brings over 45 years of experience in Christian financial planning, emphasizes this approach. When you operate from this mindset, tithing stops feeling like an obligation and starts feeling like an investment in what matters most.

Tithing First Changes Everything

Tithing isn’t outdated. It’s one of the most practical ways to keep God first in your finances, and it works because it forces a decision before you spend anything else. When you tithe first, you’re not giving what’s left over-you’re giving what matters most. That’s the opposite of how most people handle money. They spend, they save a little, and they give if anything remains. Flipping that order changes your entire financial psychology.

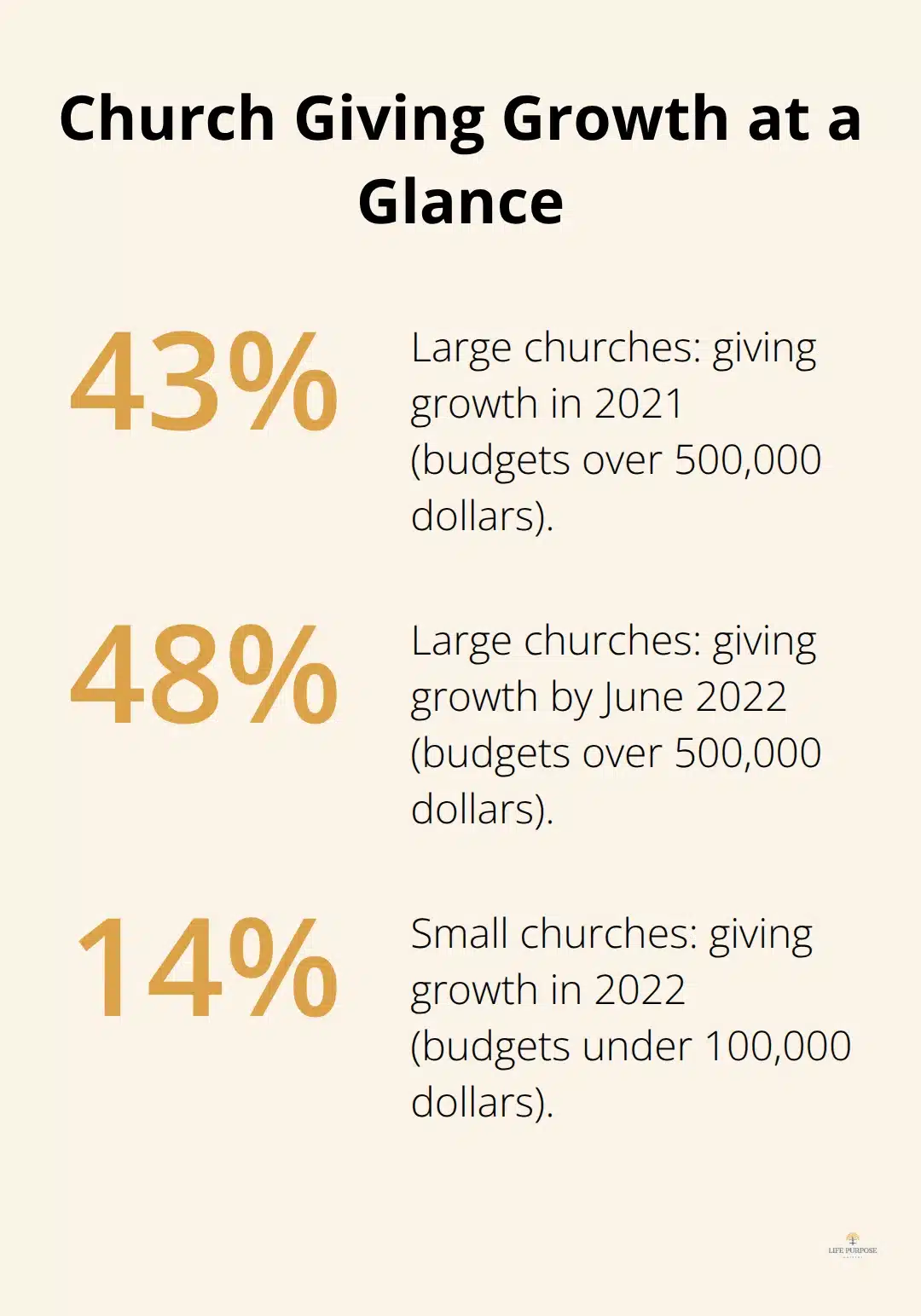

The data supports this perspective. Churches with annual budgets over 500,000 dollars saw giving growth rise from 43 per cent in 2021 to 48 per cent through June 2022, according to Horizons Stewardship. Smaller churches with budgets under 100,000 dollars faced a steeper challenge, with giving growth dropping from 37 per cent in 2021 to just 14 per cent in 2022. This isn’t just about numbers-it reflects how people respond when they see their money making a real impact aligned with their values.

Contentment Compounds Faster Than Income

Contentment matters more than income in determining financial security. A couple earning 12,000 dollars annually who saves 1,000 dollars per year at 6 per cent interest would accumulate approximately 24,672 dollars over 15 years. From that savings, they could withdraw 2,000 dollars annually for 10 years and still have roughly 15,322 dollars remaining. This shows that discipline compounds faster than income increases.

The trap of materialism isn’t about having nice things-it’s about needing them to feel secure or valuable. The borrower is servant to the lender, and modern consumer culture banks on this exact dynamic. Buy-now-pay-later schemes, credit cards, and endless subscriptions create a psychological loop where spending feels like freedom but produces bondage.

Breaking Free From the Spending Cycle

Avoiding this trap means making a conscious choice to live on less than you make, not because deprivation is spiritual, but because margin creates actual freedom. When you’re not enslaved to payments, you can respond generously to opportunities. When you’re not chasing upgrades, you can invest in what genuinely matters-whether that’s your marriage, your community, or your ability to give.

This foundation of biblical money management-viewing money as God’s tool rather than your possession, prioritising giving over spending, and building contentment over consumption-prepares you to take the next step: actually building a financial strategy that reflects these values. The principles matter, but the practical application is where your faith meets your future.

Building a Faith-Based Financial Strategy

Align Your Goals With What Actually Matters

Knowing that God owns everything and that contentment matters more than income is one thing. Actually building a financial strategy around those truths is another. The gap between belief and practice is where most people stumble, and a clear plan makes all the difference. Your strategy doesn’t need to be complicated, but it does need to be intentional.

Start by identifying three to five specific financial goals that align with what you actually believe matters. Not what society says should matter, not what your neighbours are doing, but what reflects your deepest convictions about faith, family, and generosity. If supporting your church’s building project matters to you, that’s a goal. If paying off debt so you can give more freely matters to you, that’s a goal. If funding your child’s Christian education matters to you, that’s a goal.

Write these down and attach a number and timeline to each one. A couple earning a modest income who decides their goal is to save 200 dollars monthly for a mission trip in three years has a concrete target. That specificity transforms vague intentions into actionable plans you can actually track and adjust.

Separate Your Spending Into Three Categories

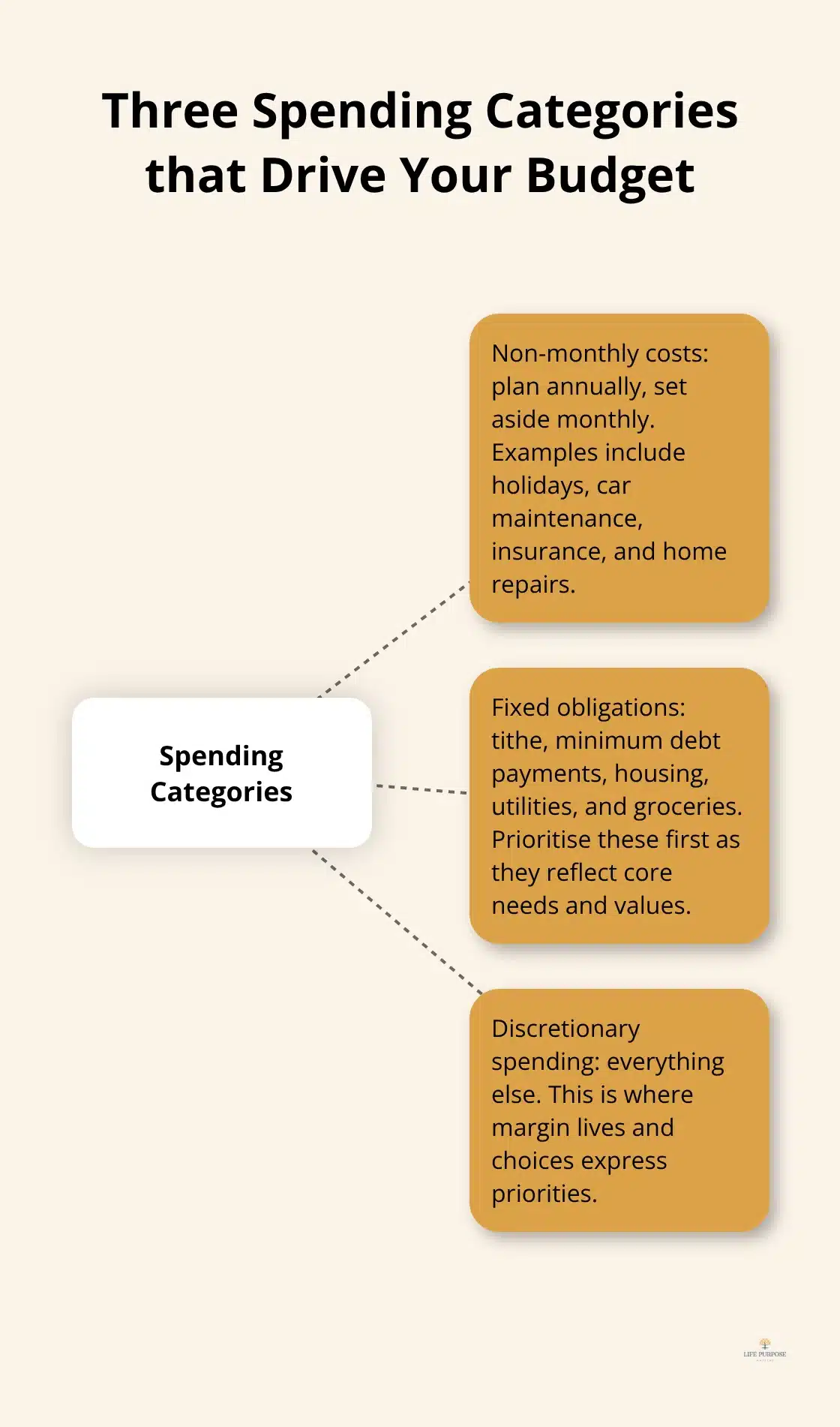

Your budget is the mechanism that makes these goals real, and the most practical approach separates your spending into three clear categories: non-monthly costs, fixed obligations, and discretionary spending. Most people fail at budgeting because they lump everything together and wonder why the numbers never work.

Non-monthly expenses like annual vacations, holiday gifts, home repairs, and car maintenance need calculation as monthly amounts and consistent setting aside. If your car insurance costs 1,200 dollars annually, that’s 100 dollars you need to budget every single month, not scramble for in November. Fixed obligations include your tithe, minimum debt payments, housing, utilities, and groceries. These are the line items you commit to first because they reflect your priorities and your basic needs. Everything else is discretionary, and this is where margin lives.

Build a Cash Cushion Before You Start

Many financial advisors recommend building a cash cushion of three to six months of income before you even start serious budgeting, because surprise expenses derail even the best plans. When you have liquid funds available, you stop treating every unexpected cost as a crisis that requires borrowing. This single practice changes your ability to stick with a budget long term.

The goal isn’t perfection or deprivation, it’s alignment. Your budget should reflect that you give generously, save intentionally, and spend thoughtfully on what genuinely matters to your family’s faith and values. Once you establish this foundation, you’re ready to think bigger about how your money can actually grow while staying true to those same principles.

Growing Your Wealth Without Compromising Your Values

Investing feels risky when you care about doing it right. The pressure to chase returns, the fear of missing out on hot stocks, and the complexity of financial markets make many Christians avoid investing altogether. That’s a mistake. Not investing is itself a choice with consequences. A couple who saves 1,000 dollars annually at 6 per cent interest accumulates roughly 24,672 dollars over 15 years, but that same couple who invests in low-cost index funds historically averaging 8 to 10 per cent annual returns could accumulate 35,000 to 40,000 dollars. The difference isn’t luck or timing-it’s the power of compound interest working in your favour.

Only Invest in What You Understand

The real challenge isn’t whether to invest but how to do it in ways that align with your faith and don’t keep you awake at night. Start with this single rule: invest only in things you can explain. This rule eliminates 90 per cent of the financial traps that catch believers. If a financial advisor recommends something you don’t understand, walk away. High-fee mutual funds, complicated derivatives, and unexamined hot tips drain your returns through fees and emotional decisions.

Instead, focus on low-cost index funds and ETFs that track broad market segments. Vanguard, Fidelity, and similar platforms offer these with expense ratios under 0.20 per cent annually, meaning your money actually stays invested instead of paying intermediaries. Avoid anything marketed as exclusive or requiring special access. The best investments in history have been boring, boring, boring. Your retirement account should be too.

Find Advisors Who Share Your Values

For those seeking guidance aligned with Christian principles, advisors like Bertram Financial in Wisconsin blend investment strategy with faith-based planning. You should verify any advisor’s registration through the SEC’s Investment Adviser Public Disclosure database before committing money. This simple step protects you from unlicensed operators and gives you confidence that someone has met basic regulatory standards.

Retirement Planning Serves Your Life, Not the Reverse

Retirement planning shouldn’t consume your entire financial life. This is where many Christians get it wrong. They save aggressively for retirement while neglecting marriage, children’s education, or the ability to respond generously to their community today. Philippians 4:19 reminds us that God supplies our needs, which means you can trust divine provision while planning prudently.

If your current income feels insufficient for both present needs and retirement savings, adjust your spending rather than borrowing. A family with modest income that prioritises funding their child’s youth group retreat over maximising a 401k makes a spiritually sound choice. That said, retirement planning matters because you will eventually stop working.

Calculate What You Actually Need

The practical approach involves three concrete steps: calculate your expected annual expenses in retirement, determine your target retirement age, and work backward to find your required monthly savings. If you need 40,000 dollars annually and plan to retire in 20 years, your required monthly savings depends on your expected investment returns and starting balance.

Online calculators at Fidelity and Vanguard can model this without pressure to buy anything.

Your legacy matters too. Proverbs 13:22 speaks to leaving an inheritance for heirs, and that inheritance doesn’t have to be massive. A deliberate investment plan that creates even modest wealth transfer to your children or grandchildren demonstrates stewardship across generations and teaches them that faithfulness compounds over time.

Final Thoughts

Christian financial planning isn’t about becoming wealthy or impressing anyone with your net worth-it’s about building a financial life that reflects what you actually believe and creating the freedom to live out your faith without constant financial stress. The pastor tracking his spending in a spreadsheet understood this truth. His budget was a spiritual document because it showed his priorities, his values, and his commitment to alignment between belief and action.

Start small if you need to. Cut one unnecessary subscription and redirect that money to your emergency fund or your tithe. Have one conversation with your spouse about what financial goals actually matter to your family. Open a low-cost investment account and make your first contribution. These aren’t dramatic moves, but they’re real moves that align your money with your convictions, and Life Purpose Matters offers Christian living inspiration and faith-based encouragement designed to support your spiritual journey as you integrate your faith more fully into your daily life.

Your financial future isn’t determined by your income-it’s determined by your decisions, your discipline, and your willingness to let your faith guide how you handle money. That future starts now, and the resources you need exist to help you move forward with confidence and purpose.