Financial conflict is a major cause of marital strain. A shared, prayerful budget brings unity and peace to the home. Christian budgeting is fundamentally different from secular financial planning because it moves beyond simply managing money to stewarding resources entrusted by God. It is the practice of aligning financial habits with biblical principles, such as generosity, contentment, and diligent planning, which brings peace, reduces stress, and strengthens faith.

Table of Contents

ToggleAt Life Purpose Matters, we’ve seen how Christian budgeting transforms families who feel trapped by money stress. When you align your finances with your faith, something shifts. You stop fighting about money and start working together toward what matters most.

Why Your Family’s Money Matters Spiritually

The coffee subscription was just the symptom. The real disease was that money had become something we did to each other rather than something we managed together. That £40 monthly charge sparked an argument because we had no shared vision for our finances, no agreement on priorities, and no plan rooted in anything deeper than avoiding overdraft fees.

Money Stress Corrodes Your Relationships

Money stress in families isn’t really about the money-it’s about feeling out of control and disconnected from what you actually value. Research from the American Psychological Association found that 75 per cent of adults are stressed by money. That stress doesn’t stay confined to the budget spreadsheet. It bleeds into your marriage, your parenting, your health, and your faith.

When couples argue about money once a week or more, their divorce risk increases dramatically. Financial anxiety corrodes relationships faster than almost anything else. Couples who don’t communicate about money tend to hide spending, avoid conversations about debt, and build resentment that festers for years. Singles struggle differently: without accountability, spending often spirals into patterns that contradict their values.

The Physical Toll of Financial Anxiety

Financial stress triggers cortisol release, which contributes to sleep problems, weakened immunity, and chronic anxiety. Over time, this creates a cycle where poor financial decisions stem from stress-induced exhaustion, which generates more stress. Your body literally cannot rest when your finances feel chaotic.

Breaking this cycle requires a plan-a specific, written budget that both partners agree on and understand completely. The good news is that families who implement a faith-based budget report measurable improvements within months. They experience less conflict, sleep better, and report greater alignment with their values.

Stewardship Changes Everything

The biblical foundation for this isn’t complicated. Psalm 24:1 establishes that God owns everything. You’re not the owner of your paycheck; you’re the steward. That distinction changes everything. A steward manages what belongs to someone else, which means you’re accountable for how you use it.

The parable of the talents in Matthew 25:14-30 shows that God expects stewards to multiply resources wisely, not hoard them or squander them. When you budget from this perspective, you’re not restricting yourself-you’re aligning your spending with your actual purpose. That alignment matters because it transforms budgeting from a chore into an expression of faith.

How Intentional Choices Create Clarity

When you budget intentionally, you make conscious choices about what gets your money and therefore what gets your time, attention, and energy. You decide that giving to your church comes before streaming subscriptions. You choose that your emergency fund matters more than impulse purchases. These decisions, made deliberately and together, create the opposite of stress: they create clarity, unity, and purpose.

This is where the real transformation happens. Your family stops fighting about money and starts working together toward what matters most. The next step is learning exactly how to build a budget that reflects these values and priorities.

How to Structure Your Budget Around What Matters Most

Now that you understand why budgeting matters spiritually, the practical work begins. This is where most families stumble because they try to follow generic budgeting frameworks that ignore their actual values. Your budget needs to start with a clear picture of what money actually flows in and out each month, then intentionally allocate funds in an order that reflects your faith priorities. The most common mistake we see is treating giving and savings as leftovers after discretionary spending. That’s backwards. We recommend a different approach: give first, save second, then spend what remains. This inverts the typical consumer mindset and forces you to make intentional choices about what actually matters.

Calculate Your Real Income and Fixed Expenses

Start with your actual monthly household income after taxes. This is your real number, not your gross salary. If you’re self-employed or have variable income, use an average from the past three months. Next, list every fixed expense that doesn’t change month to month: mortgage or rent, insurance premiums, utility minimums, loan payments, childcare. These numbers are non-negotiable. Write them down. Don’t estimate. Pull up your bank statements from the last three months and add them all up.

This step alone reveals why many families feel stressed. They genuinely don’t know where the money goes because they’ve never tracked it. Once you see your fixed expenses, subtract that total from your income. What remains is your discretionary money. This is where your values actually show up.

Prioritise Giving and Savings First

Allocate your first portion of discretionary money to giving. If you tithe at 10 per cent of gross income, calculate that amount and make it non-negotiable. Many families report that this feels impossible at first, yet those who commit to giving before other spending discover their finances stabilise faster than they expected.

Next, allocate funds for savings and debt repayment. If you’re carrying consumer debt, assign a specific amount monthly toward repayment. Build an emergency fund separately, trying for one month of fixed expenses in a dedicated savings account. This prevents a car repair or medical bill from derailing your entire budget.

Allocate Remaining Money With Intention

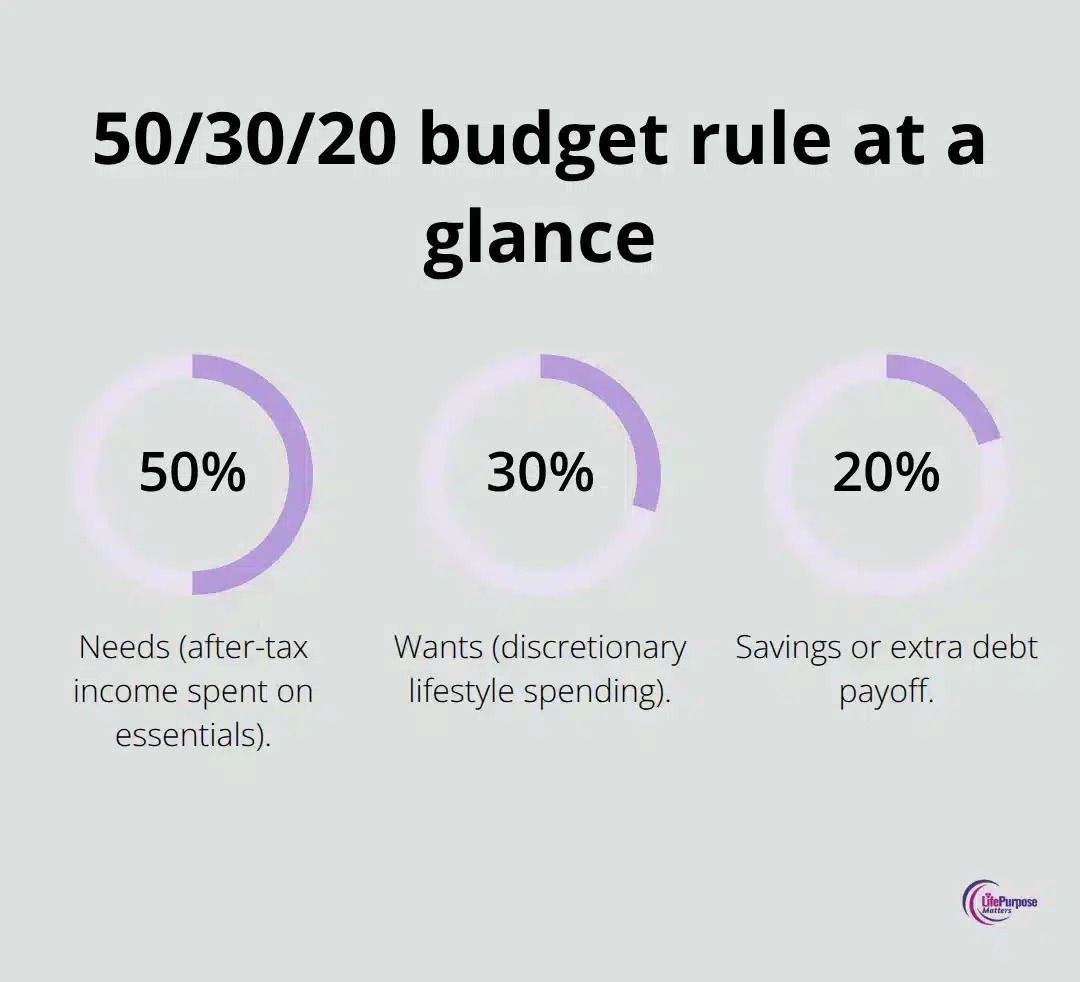

The remaining money covers everything else: groceries, transportation, utilities beyond minimums, personal spending, entertainment. This is where the 50/30/20 budget rule can help, though adapt it to your situation. The framework suggests spending up to 50% of your after-tax income on needs, 30% on wants, and 20% toward additional savings or debt payoff. The exact percentages matter less than having a written plan.

Choose Tools That Match Your Style

Use a spreadsheet, a tool like EveryDollar (which offers bank linking and automatic categorisation), or even the cash envelope method if you spend more intentionally with physical money. The critical factor is that your budget must be written and reviewed monthly. Expect the first month to feel chaotic and the second month to require corrections. Within three months, your budget reflects reality and becomes your financial blueprint.

This foundation sets you up for success, but a written budget only works when both partners understand it completely and commit to it together. The next step is learning how to have the conversations that keep your budget alive and your family aligned.

Making Your Budget Actually Stick

A written budget means nothing if it sits in a drawer gathering dust. The real work happens when you track where money goes, use tools that fit your life, and talk about it consistently. Most families abandon budgets within six weeks because they treat them as punishment rather than protection. You need systems that work with your personality, not against it, and you need conversations that keep everyone aligned instead of resentful.

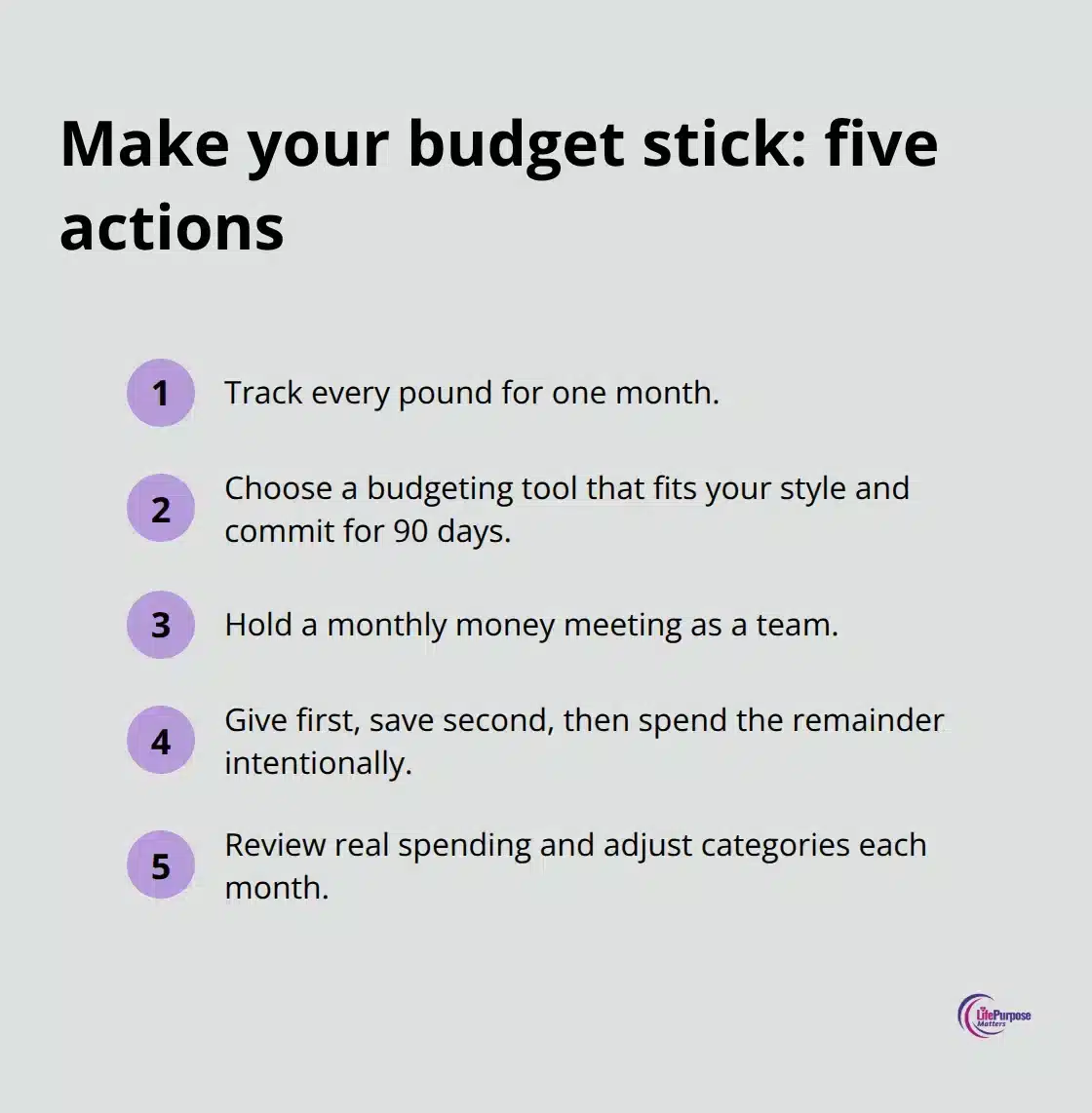

Track Your Spending Before You Plan

Start by tracking every single pound for one month before you even create your budget. Pull bank statements, credit card receipts, and cash spending. This initial audit reveals what most families never see-recurring charges you forgot about, spending categories that surprise you, and patterns that contradict your stated values. That visibility transforms budgeting from guesswork into strategy.

Choose Tools That Match Your Personality

The tool you select matters less than consistency, so pick one and commit to it for at least three months. If you prefer hands-on control and tangible spending limits, the cash envelope method works better than any app because you physically see money leave your hands. If you’re tech-forward and want automatic categorisation, EveryDollar links to your bank account and sorts transactions into categories you’ve defined, saving you hours each month. If you like flexibility and simplicity, a spreadsheet with monthly tabs costs nothing and gives you complete control.

Expect month one to feel chaotic because you’ll discover expenses you forgot existed and spending patterns that surprise you. Month two allows corrections as you see which categories need adjustment. Month three is when your budget finally reflects your actual life and becomes sustainable. This is also when you stop viewing it as restrictive and start seeing it as liberating because you know exactly where your money serves your priorities.

Have Monthly Money Conversations That Matter

Schedule 30 to 45 minutes on the same day each month, ideally before bills are due. Review last month’s actual spending against your plan, celebrate wins like debt paid down or savings milestones reached, and adjust categories that need tweaking. Couples who talk about money monthly report significantly less conflict than those who avoid the conversation until crisis hits. Make these meetings feel collaborative, not confrontational-bring coffee, acknowledge where you both stayed on track, and treat it as a team huddle rather than a performance review. When you align your spending with your values, it stops being the thing you fight about and becomes the thing you manage together.

Final Thoughts

Christian budgeting transforms how families relate to money and to each other. When you structure your finances around what you actually believe matters, the arguments about coffee subscriptions stop, the hidden resentment fades, and you build something stronger: a shared vision where money serves your values rather than controls them. God owns everything, and you act as the steward-your paycheck is a resource you manage on behalf of something bigger than yourself, which means giving comes first, savings comes second, and spending what remains becomes intentional rather than reactive.

Check out >> The Ideal Faith Base Hustle Ideas

The practical work requires three concrete actions. Know your actual numbers by tracking every pound for a month and understanding where money currently flows. Choose a tool that fits your personality-whether a spreadsheet, an app, or cash envelopes-and commit to it for ninety days. Talk about money monthly as a team, and these conversations prevent the secrecy and resentment that destroy marriages while creating the unity that strengthens them.

Families who implement these steps report measurable changes within months: less conflict, better sleep, greater alignment with their faith, and more freedom to be generous because they no longer drown in debt or anxiety. Start your budget this month, have that first money conversation with your spouse, and watch what happens when your family’s finances finally reflect what you actually believe. We at Life Purpose Matters offer resources and encouragement for your spiritual journey as you align every area of your life with your faith.