Julie stared at her credit card statements scattered across the kitchen table, feeling overwhelmed by the mounting balances. Honouring God while tackling financial struggles involves shifting focus from fear to trust, practising stewardship, and maintaining generosity, even when resources are scarce. Biblical principles suggest that financial crises are opportunities to rely on God’s provision and develop character. Like many Christians, she wondered how to honour God while tackling her financial struggles.

Table of Contents

ToggleWe at Life Purpose Matters believe debt freedom isn’t just about numbers-it’s about aligning your finances with biblical principles. When faith guides your money decisions, you create a path toward both spiritual and financial peace.

Biblical Principles for Financial Management

Scripture presents a clear framework for money management that goes beyond secular advice. Proverbs 21:20 states that the wise store up choice food and olive oil, but fools gulp theirs down. This verse establishes saving as a biblical mandate rather than a suggestion, directly countering consumer culture that encourages people to spend everything they earn.

The Bible contains over 2,000 verses about money and possessions, making it one of the most frequently discussed topics in Scripture. Deuteronomy 8:18 reminds us that God gives the power to gain wealth, meaning our income abilities come from divine provision, not personal achievement alone.

God’s Position on Debt and Borrowing

The Bible takes a firm stance on debt without completely forbidding it. Proverbs 22:7 warns that the borrower becomes a slave to the lender, highlighting how debt creates bondage rather than freedom. Romans 13:8 instructs believers to owe no one anything except love, suggesting debt should be temporary and purposeful.

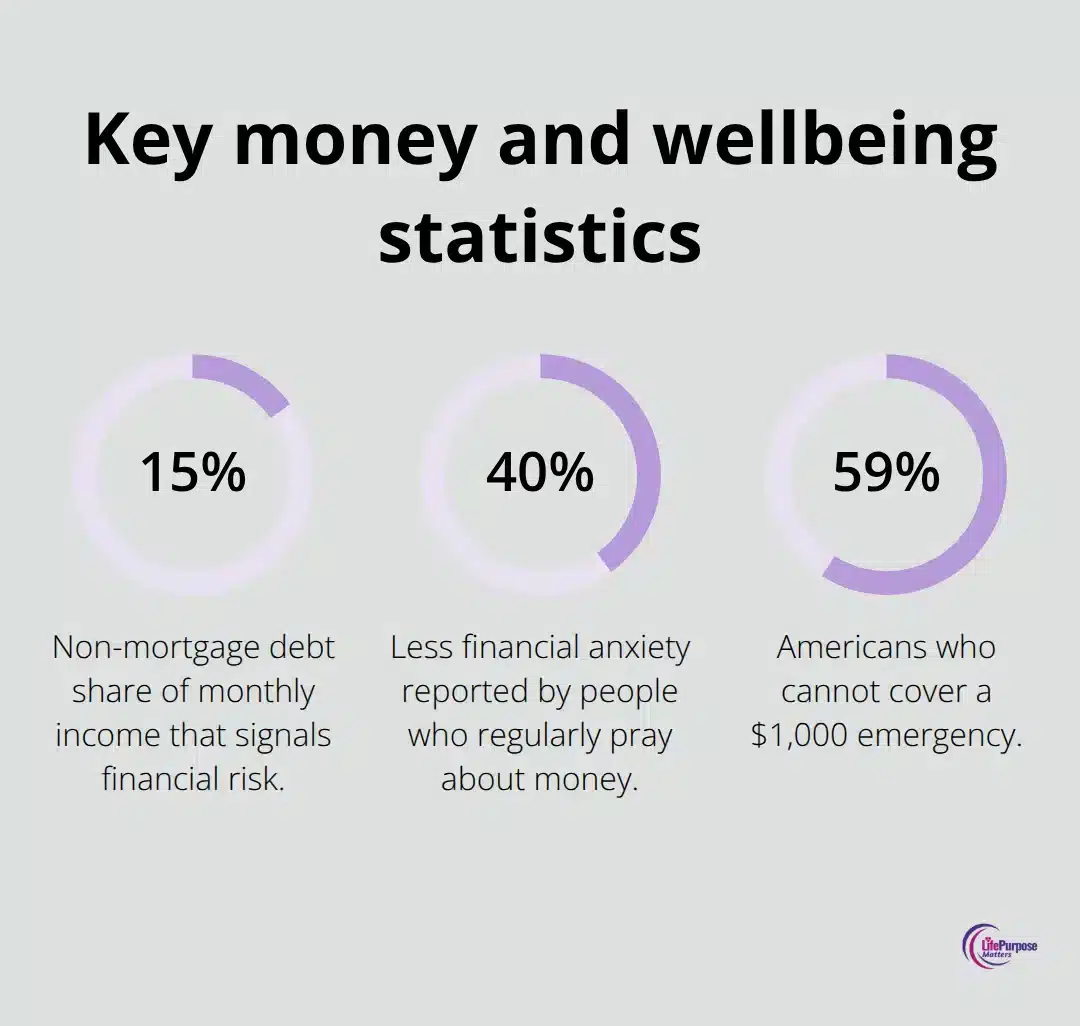

Scripture shows debt arising from unfortunate circumstances (like the widow in 2 Kings 4), but emphasises quick resolution. Research shows that money impacts mental health significantly, with debt being a primary source of financial stress. Financial experts note that when non-mortgage debt exceeds 15% of monthly income, families enter dangerous territory that affects both spiritual and emotional well-being.

Prayer-Based Financial Decisions

James 4:13-15 teaches against making financial plans without considering God’s will, yet most Christians make money decisions without prayer. The practice of Prayer Before Payment encourages believers to seek divine wisdom before major purchases or financial commitments.

Studies indicate that individuals who regularly pray about finances report 40% less financial anxiety than those who don’t. Malachi 3:10 demonstrates that tithing during financial hardship often opens unexpected opportunities, with research showing generous givers receive an average return of $3.75 for every dollar donated to charity.

Stewardship vs Ownership Mindset

Scripture teaches that God owns everything and we serve as stewards of His resources. This perspective transforms how Christians approach money management. Psalm 24:1 declares that the earth belongs to the Lord, including everything in it.

When you view money as God’s resource entrusted to your care, spending decisions become acts of worship rather than personal choices. This stewardship mindset shift helps believers prioritise needs over wants and consider eternal impact over temporary satisfaction.

Now that you understand these biblical foundations, you need practical steps to eliminate debt while honouring these principles.

Practical Steps to Eliminate Debt

The most effective debt elimination strategy starts with a biblical budget that reflects God’s priorities. Creating written financial plans helps people successfully reduce their debt, as documented in debt research. Your budget should allocate income in this order: tithe first (Malachi 3:10), cover essential needs, make minimum debt payments, then tackle extra debt reduction. This approach honours God while you create financial margin for debt elimination.

The Debt Snowball Method Delivers Results

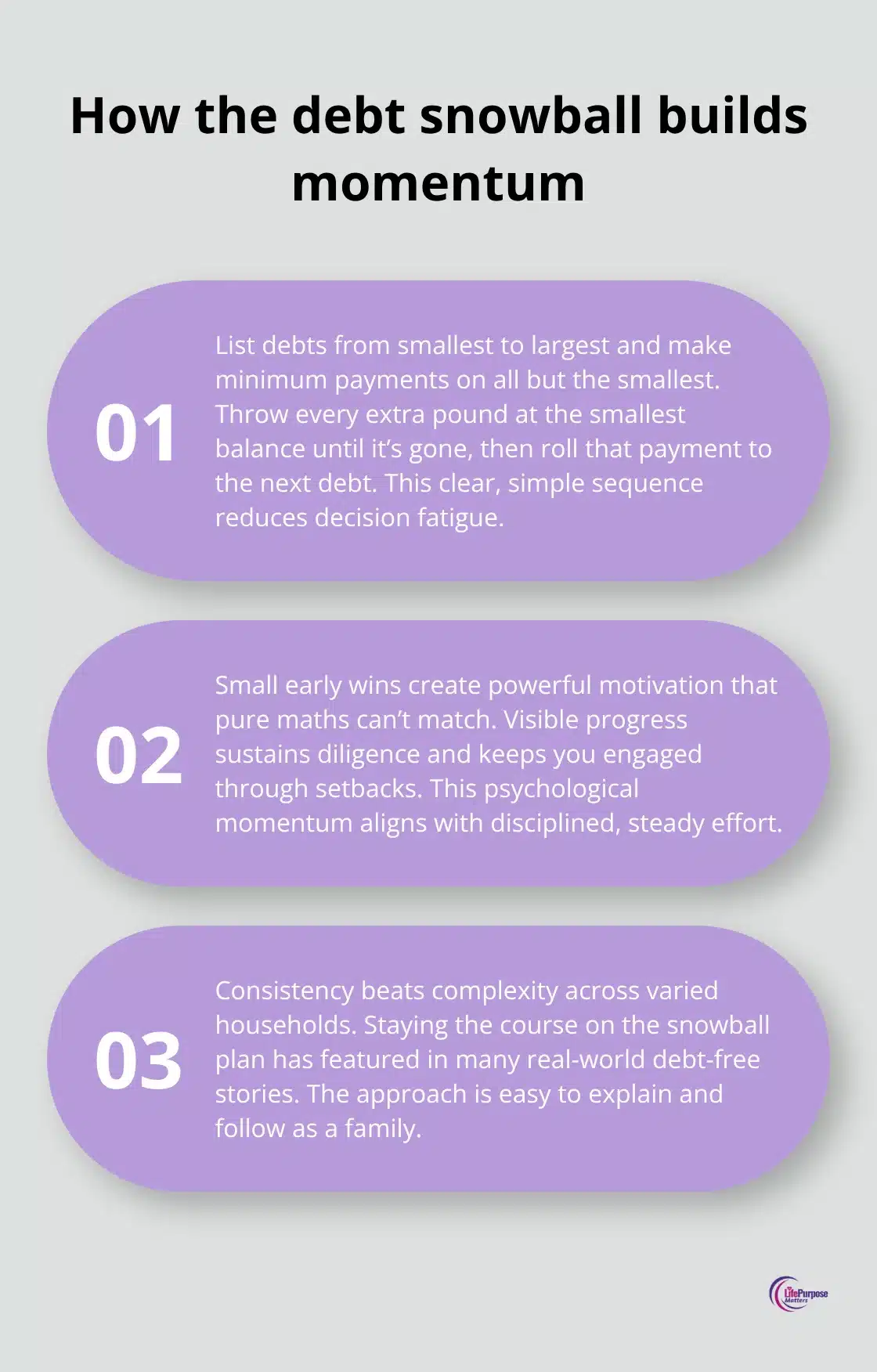

Financial experts debate snowball versus avalanche methods, but the debt snowball method has been studied for its effectiveness among different populations. List all debts from smallest to largest balance, make minimum payments on everything, then attack the smallest debt with every extra dollar. Many debt-free success stories involve people who used the snowball method consistently.

The psychological wins from the elimination of small debts create momentum that mathematical optimisation cannot match. Proverbs 14:23 emphasises that diligent labour brings profit, and the snowball method channels this principle through visible progress that motivates continued effort.

Boost Income Through Biblical Work Ethics

Colossians 3:23 commands believers to work heartily as unto the Lord, which transforms your approach to income generation. Christians who view work as worship consistently outperform peers in salary negotiations and promotion opportunities. Employees who demonstrate integrity, reliability, and excellence typically receive more raises than average workers.

Side hustles should align with Christian values while you maximise the skills God gave you. Whether you freelance, consult, or start a small business, apply biblical principles of honest dealing and quality service. The goal isn’t just more money but effective stewardship of your talents while you serve others through your work.

Create Multiple Income Streams

Ecclesiastes 11:2 advises giving portions to seven or eight people because you don’t know what disaster may come. This wisdom applies to income diversification (not just charitable giving). Develop 2-3 income sources that complement your primary job without compromising your work quality or family time.

Check out our ==>>Purposeful Digital Product Ideas You Can Create and Sell Today << ==

Consider skills-based services like tutoring, bookkeeping, or home repairs. Online platforms make it easier than ever to monetise talents while maintaining Christian integrity in all business dealings.

Once you establish these debt elimination strategies, you need systems that prevent future financial setbacks and build lasting wealth.

Building Long-Term Financial Stability

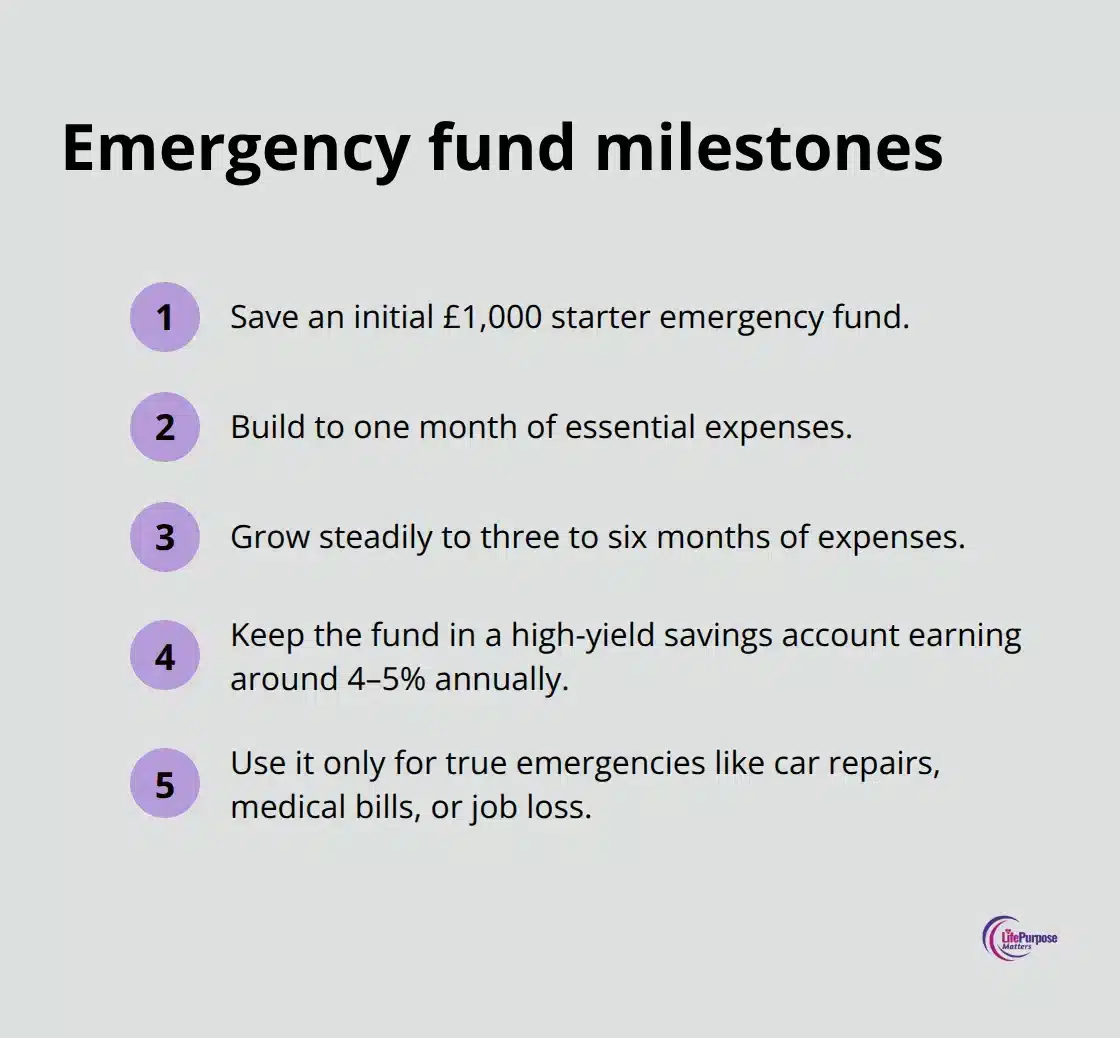

Debt elimination creates space to breathe, but lasting financial security requires three foundational elements: emergency funds, faith-aligned investments, and biblical money education for your children. Most financial advisers recommend 3-6 months of expenses in savings, yet 59% of Americans cannot cover a $1,000 emergency.

Christians should view emergency funds differently than secular financial advice suggests. Your emergency fund serves as a buffer that prevents you from falling back into debt when life happens, and it demonstrates trust in God’s provision while you take practical responsibility for your household.

Emergency Fund Strategy

Start with £1,000 as your initial goal, then build toward one month of expenses and gradually increase to six months. Keep this money in a high-yield savings account that earns 4-5% annually rather than a traditional savings account that pay 0.01%. Marcus by Goldman Sachs and Ally Bank consistently offer competitive rates without minimum balance requirements.

This fund protects your family from unexpected car repairs, medical bills, or job loss without derailing your debt-free progress. Proverbs 21:20 shows that wise people store up resources while fools consume everything immediately.

Faith-Based Investment Principles

Investment strategies must align with Christian principles while you build wealth for kingdom purposes. Avoid companies that profit from activities like gambling, alcohol, tobacco, or other industries that contradict biblical values. Faith-based investment funds like the Timothy Plan or GuideStone Funds screen investments according to Christian ethical standards while they deliver competitive returns.

Historical data show that socially responsible investments perform as well as traditional investments over long periods. Proverbs 13:11 teaches that wealth gained hastily will dwindle, but whoever gathers money little by little makes it grow. This principle supports consistent monthly investments rather than attempts to time markets or chase quick gains.

Dollar-cost averaging into broad market index funds reduces risk while you build wealth systematically. Try to invest 10-15% of income for retirement, and start with employer 401k matches since this represents free money that compounds over decades.

Teaching Children Biblical Money Management

Children who learn biblical money principles demonstrate better financial decision-making as adults, with financial habits formed by age seven, according to Cambridge University research. Start teaching stewardship concepts when children receive their first allowance or earnings.

The three-jar method works effectively: Give, Save, and Spend jars teach children to allocate money according to biblical priorities from an early age. Children should tithe first from any money they receive, which demonstrates that God gets the first portion rather than leftovers.

Age-appropriate financial education includes price comparisons at grocery stores, explanations of why families budget, and simple examples of how compound interest works. Teenagers should learn about credit scores, student loan implications, and career planning that considers both calling and earning potential. Involve older children in family budget discussions so they understand the real costs of housing, utilities, and transportation before they leave home.

Final Thoughts

Your journey toward debt freedom represents more than financial improvement-it demonstrates faith in action through practical stewardship. The biblical principles we’ve explored provide a foundation that secular financial advice cannot match because they address both your spiritual and material needs simultaneously. When you face setbacks or unexpected expenses, Philippians 4:19 promises God will supply all your needs according to His riches (these moments test your faith but also strengthen your dependence on divine provision rather than credit cards or loans).

The path forward involves consistent application of biblical budgets, generous gifts, and wise savings habits that reflect kingdom values. Your financial transformation impacts your family, church community, and future generations who will benefit from the stewardship principles you model today. Daily choices that honour God above temporary desires will solidify your commitment to His financial plan.

We at Life Purpose Matters support Christians who seek to live out their God-given purpose through faithful money management. Our resources help believers honour biblical teachings while they build lasting financial security. Your debt freedom journey starts with the first step of faith-based financial decisions that align with Scripture.